Volatility Trading - Protecting Your Portfolio From Crisis

- AllQuant

- Apr 3, 2023

- 3 min read

The key to having a resilient portfolio that can weather stock market downturns is to have a strategy that can thrive during a market crisis. There are not many straightforward strategies that can do that. One is to short-sell stocks. Another is to buy put options. But history has shown that both approaches lose money over the long run. At best, they act like an insurance policy but not as an alpha generator. In other words, adding such strategies to a portfolio can reduce volatility but at the cost of lowering returns.

Volatility Risk Premium Strategy - Income & Protection

One of the strategies we teach at AllQuant is Volatility Risk Premium (VRP). We also use a more advanced version of this strategy with the financial advisors we work with for their clients. This strategy serves a dual purpose. While most hedging strategies pay for protection and drag down overall performance in the long term, our VRP strategy aims not only to protect but also to profit. This is done by focusing on 2 areas:

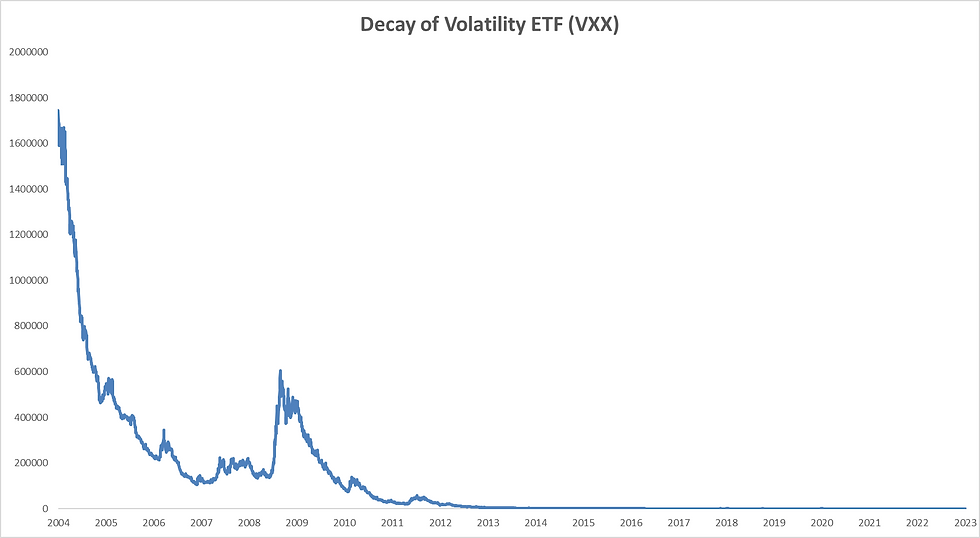

1. Generate variable income - A unique feature of Volatility as an asset class is that by nature of its term structure, it usually has a built-in decay. That means as time goes by, it drops in price if no major event or change in sentiment happens in the market (see how VXX price decays from 2004).

With the right strategy and risk management, we can capitalize on this to ride on the decay by shorting volatility and in the process generate a decent income from it over the long term.

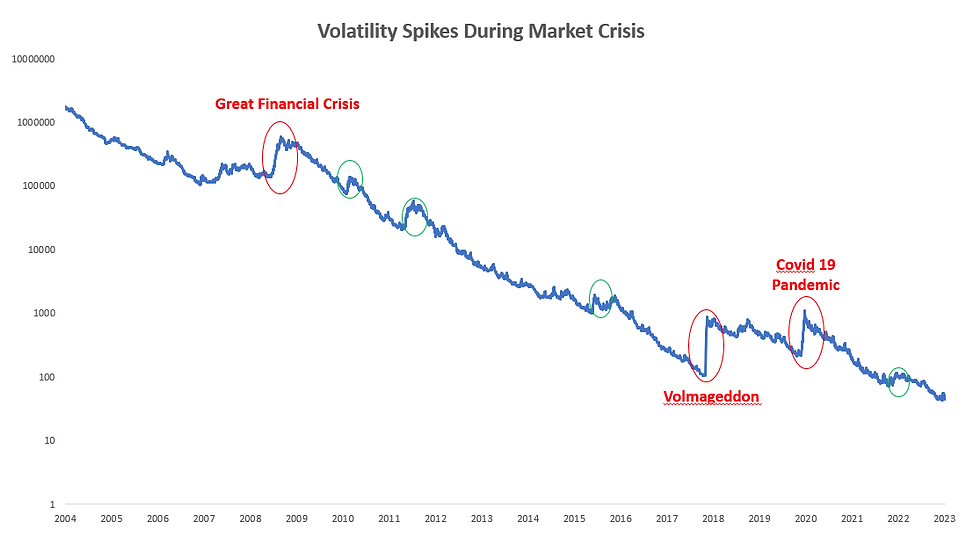

2. Profit from volatility spikes during a crisis - You may also have noticed the occasional sharp spikes that occur in the prior chart. These coincide with periods when the US stock market undergoes a correction or major crisis. To see these spikes more clearly, the same chart above is presented in log prices below else the more recent spikes would hardly be visible.

Our VRP strategy also aims to turn long on volatility during such periods to profit from these spikes. By doing so, this strategy can also act as a potential crisis hedge.

How Has The Volatility Risk Premium Strategy Performed?

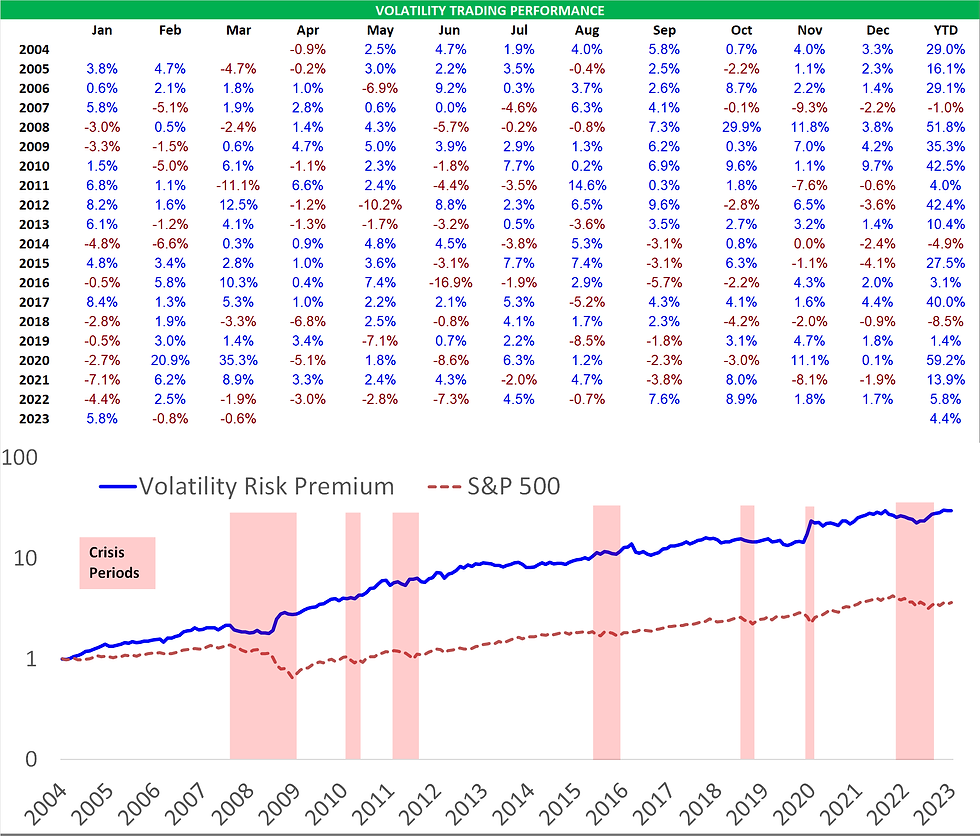

The VRP strategy model performance delivered in most years since 2004 and outperformed the S&P 500. But do note that the month-on-month moves can be rather volatile. This is the nature of Volatility as an asset class, they can be prone to sudden and huge moves. But with proper sizing, this risk can be mitigated. Overall, this strategy is a good alpha generator in its own right, but the key unique feature is its exceptional performance during a stock market crisis.

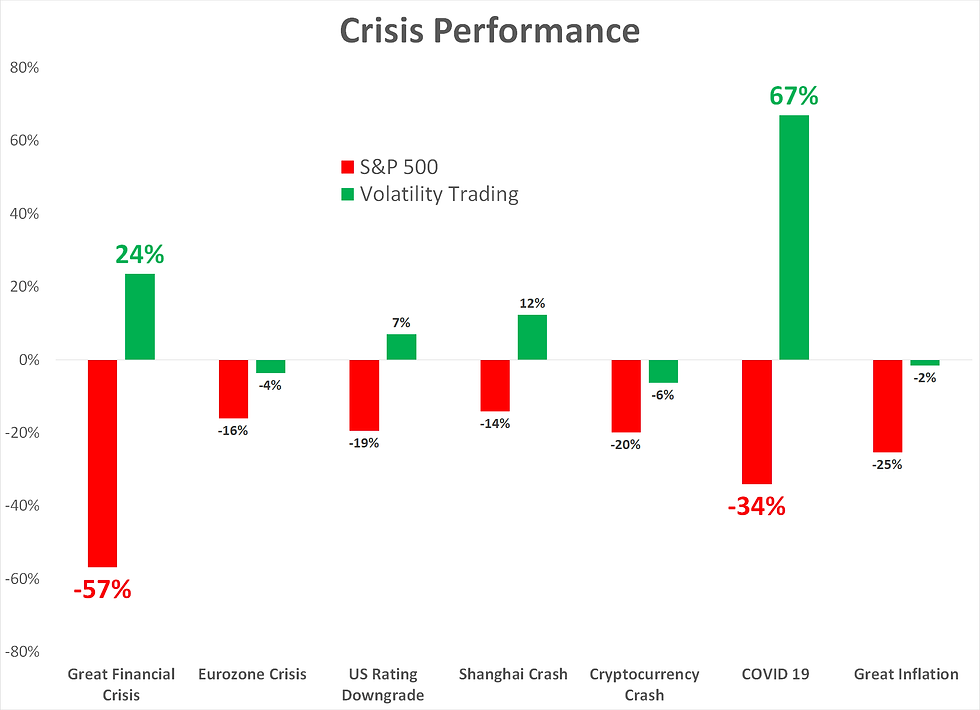

VRP can generate good profits during severe events like the Great Financial Crisis and the Covid-19 outbreak. It is also resilient during other run-of-the-mill risk-off periods.

2022 Performance

However, the VRP strategy can be a bit of a wildcard at times especially when it is near the switching zone between going into income mode or protection mode. There will be periods where the strategy undergoes whipsaws and tanks together with the stock market. An example of this is what happened in 2022.

When the S&P 500 went down during the first half of 2022, VRP went down together. However, it started to perform in the second half while S&P 500 languished. And by the end of the year, the S&P 500 lost 19.4%, while VRP gained 5.8% and to date as of the end of March 2023, it continues to deliver.

With the recent banking crisis and increasing risks of a recession, as the pressure of heightened interest rates cascades down, we might see more rough rides ahead. We will not be surprised if VRP is put to the test again. After all, these are precisely the times it is meant for.

Want to know more about AllQuant?

If you are interested to know more about our strategies such as this and how you can implement them yourselves or with the assistance of a financial advisor, feel free to reach out. Just click on the buttons below to find out more!

Comments