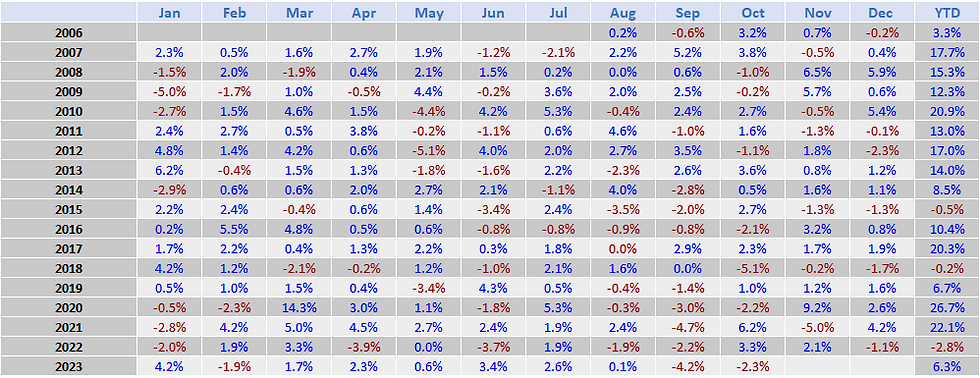

Multi-Strategy Model: October 2023 -2.3%, YTD +6.3%

- AllQuant

- Nov 1, 2023

- 3 min read

MARKET BRIEF

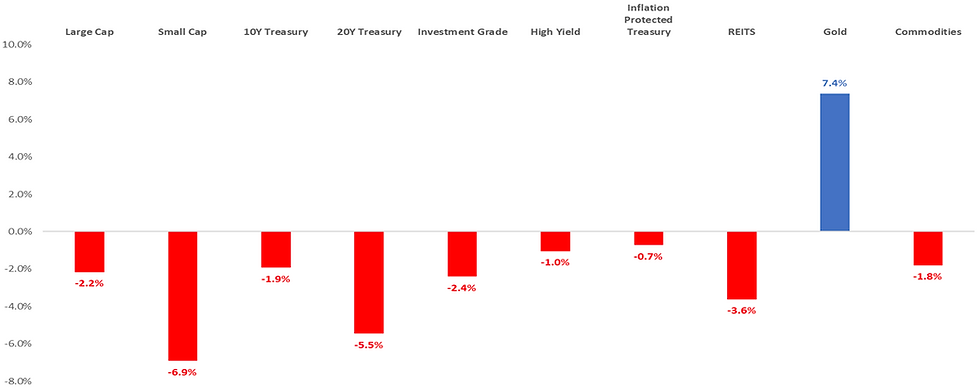

Anyone hoping for a bout of relief this month had their hopes dashed. The market rout that began in August did not ease in October. Other than gold, the downward momentum continued for most other asset classes.

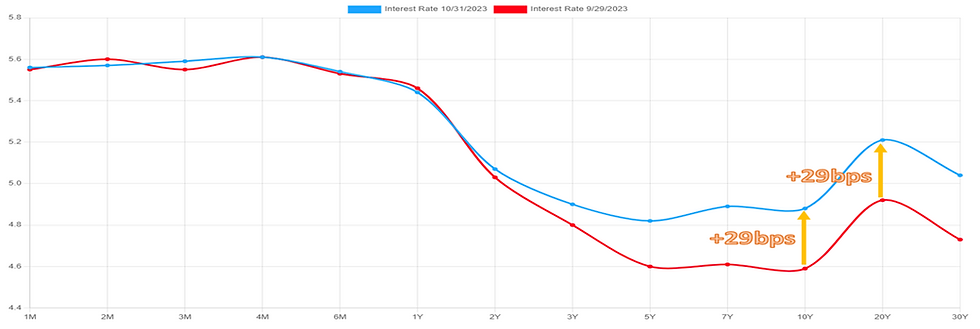

The year started on a good footing. In fact, the US stock market was very close to recovering its loss in 2022 at one point in time. However, all this was set back in the second half of this year as heavy selling over the past 3 months shaved almost 10% off its recent high before slightly recovering towards the end of the month. The driving force behind this was not something new. The dominant narrative was again interest rates. October saw major moves on the long end of the curve. Just this month alone, both the 10y and 20y yields jumped close to 30 bps. The 10Y yield now sits at 4.88% while the 20Y is 5.21%.

This comes as economic prints consistently exceed forecasts one after another implying the market has been underestimating the resilience and the strength of the US economy. On a global scale, the US has performed remarkably well against other developed nations. Talks about the probability of a recession this year have virtually vanished. The economy continues to be supported by a robust job market with healthy wage growth which in turn props up consumer spending and benefits businesses. Under normal circumstances, this strength would bode well for sentiments. But with the fight against inflation still taking center stage under a hawkish Federal Reserve, this was not what a market used to monetary easing and stimulus is hoping for. A stronger economy means that rates are likely going to stay higher for longer.

PORTFOLIO UPDATES

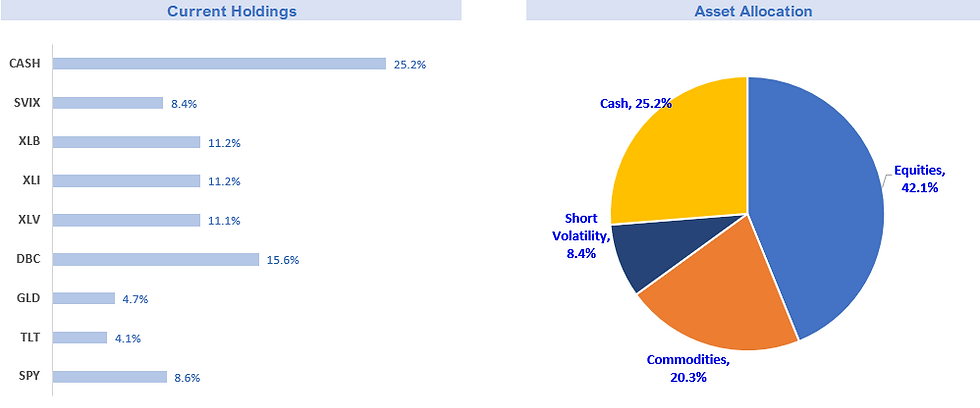

This month only the model portfolio's position in Gold delivers positive returns helping to buffer losses coming from other positions, the bulk of which comes from equities which are the largest. Moving more of the assets into cash at the start of the month also mitigates the damage from the market selloff. Our short volatility trade which represents about 8% of the model portfolio also suffered a setback this month as market volatility spikes. But in terms of YTD performance, the volatility trading strategy remains the largest profit contributor and is still sitting on good buffers.

Overall, the multi-strategy model is down -2.3% for the month and up +6.3% YTD.

Download our AQ Multi-Strategy Model Newsletter

* This is the model performance of portfolios constructed using more advanced strategies than those taught in our courses. They can be implemented with the assistance of an iFAST Global Markets (Singapore) senior investment adviser. Note that live performance may vary due to execution price slippages, the difference in sizing precisions, etc. All performances are measured in USD terms.

Let's meet for breakfast!

As part of our free financial education series, we are organizing a casual breakfast session for those who've expressed that you'd like to learn more about the markets. We are also opening up this session to everyone who is keen to join us. Have some fun over a mini stock trading game, and learn about asset allocation and the 3 wants - Protection, Income, and Growth!

11 November 2023 (Saturday)

10:00 am to 11:30 am

10 Collyer Quay

Ocean Financial Centre

Singapore 049315

If you are interested, please RSVP using the button below! See you there!

Disclaimer & Disclosure

We are not financial advisers or fund managers. The information published on this Site is provided for informational purposes only. It is not intended to be, nor shall it be construed as, financial advice, an offer, or a solicitation of an offer, to buy or sell an interest in any investment product. Nothing on this site constitutes accounting, regulatory, tax, or other advice.

Any performance shown on this Site is model performance and is not necessarily indicative nor a guarantee of future performance. You should make your own assessment of the relevance, accuracy, and adequacy of the information contained on this Site and consult your independent advisers where necessary.

AllQuant is carrying out introducing activities for iFAST Global Markets (Singapore) as an independent entity and is NOT an agent, servant, employee, representative, or in partnership with iFAST Global Markets (Singapore). AllQuant will be receiving remuneration or introducing fees from iFAST Global Markets (Singapore).

Comments