Capital Protected Portfolio - A Review On How It Has Performed

- AllQuant

- Nov 13, 2023

- 4 min read

Updated: Nov 16, 2023

We introduced the capital-protected portfolio in April this year. You can read about it here.

Six months have passed, so let's look at how the portfolio has done. To recap, the portfolio comprises two portions in a barbell structure. The first portion is invested in high-quality individual bonds like government or high-grade corporate bonds. This portion is also the bulk of the portfolio since this is the part that returns the invested capital upon maturity. The smaller portion is used to run the high-return advanced volatility trading strategy to generate the potential upside.

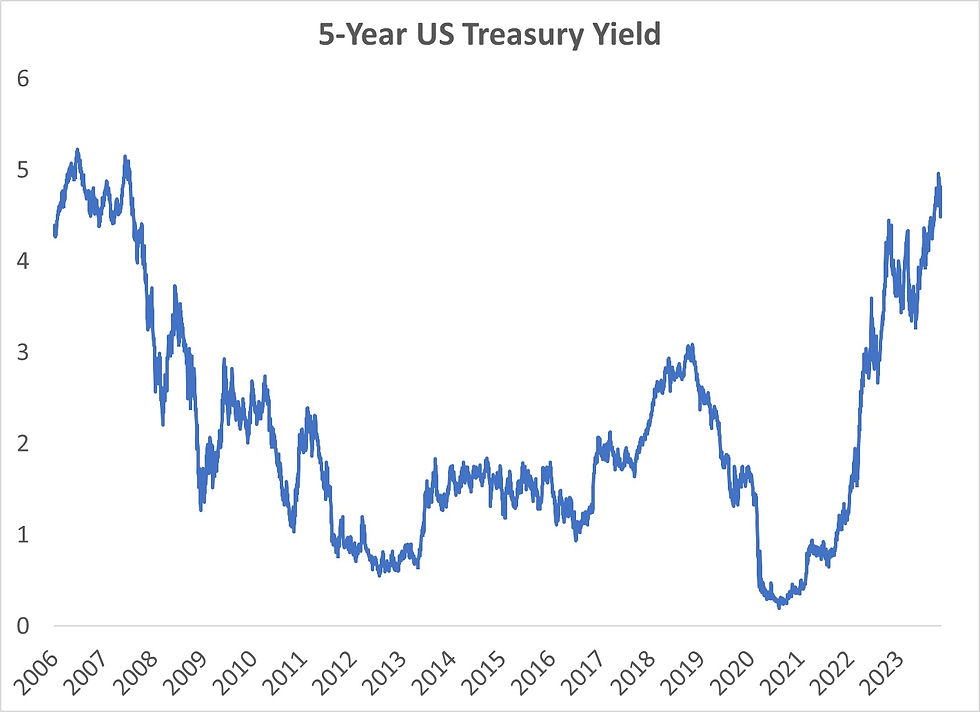

Interest Rates Still Hovering At Levels Above Pre-Great Financial Crisis But It Does Not Matter

In terms of performance, there is not much to comment on the bond portion since it is meant to be held to maturity. While interest rates have already exceeded pre-Great Financial Crisis levels and bond prices have fallen in the interim, it wouldn't matter. As long as we don't liquidate the bond and it does not default (which is unlikely if bonds of high credit ratings are used), we will get our original invested capital back in the form of principal repayment upon maturity, and coupons received along the way (if a coupon bond is used). Protection is the primary purpose for investing in the bonds.

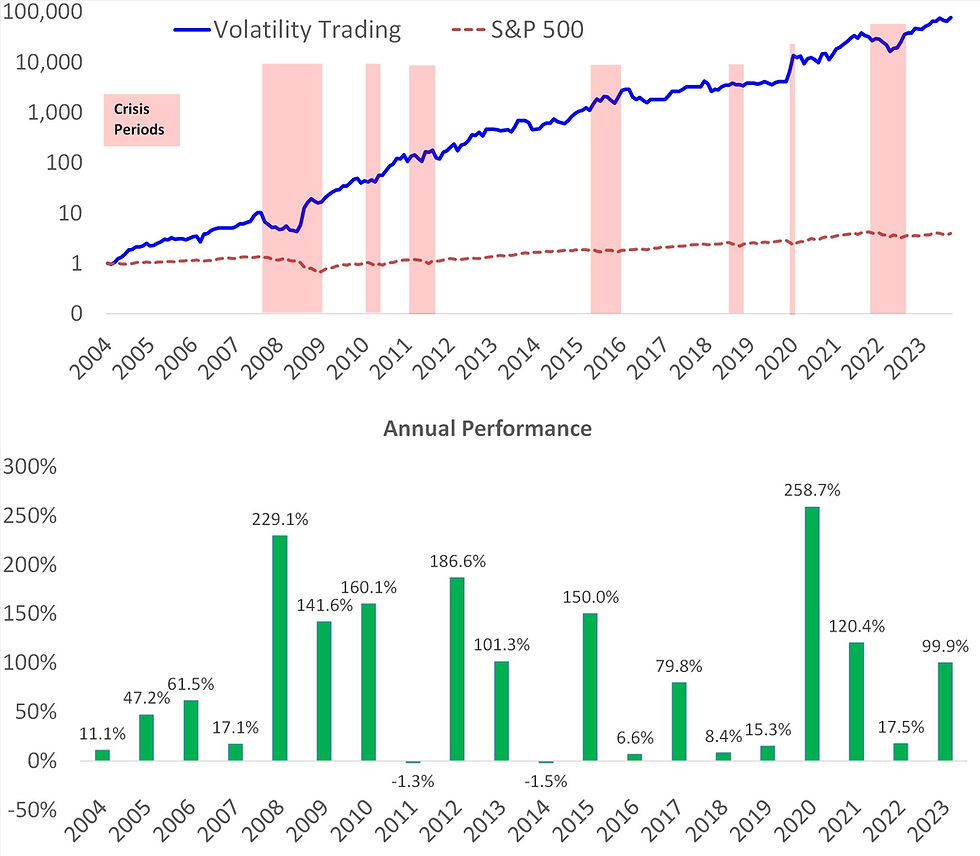

The Advanced Volatility Trading Made 100% Year-To-Date

We will focus on the more exciting volatility trading strategy which is responsible for the upside potential.

While the volatility trading model did not live up to its full crisis hedge potential last year, it still delivered a positive return and outperformed the stock markets which had a horrible run. And this year, it again outshined the stock markets by a wide margin, doubling or making 100% with what it started with. Take note that this is performance calculated solely based on the capital allocated to the volatility trading slice and not on the entire portfolio.

If we start from the end of April 2023, when we introduced the Capital Protected Portfolios, portfolios with 10-15% allocated to the advanced volatility trading strategy would be up around 5-7% today, assuming we just mark the bonds portion, which is meant to be held to maturity, at cost. All this in just 6 months for a capital-protected portfolio.

But Be Prepared To Expect High Volatility

The advanced volatility trading strategy can generate high returns. But it comes with great volatility just like any other high-return strategies. However, what is impressive is that it retains a high risk-adjusted return (Sharpe ratio).

This is the volatile nature of the strategy we have been highlighting and why we do not recommend running this strategy on a stand-alone basis. However, when combined with other less volatile strategies (Multi-Strategy portfolio) or assets (Capital-Protected portfolio), the full potential of this strategy can be unleashed.

The No-Lose Trade

Hedge fund managers like to look for asymmetric trades where the upside is much greater than the downside. Having run hedge funds ourselves, we also naturally look for such trades. This is how we came up with the idea of combining a safe bond with our high-return volatility trading strategy, which is only possible in today's interest rate environment.

In the worst-case scenario, you will get back your invested amount at the maturity of the selected bond. This is assuming the volatility trading strategy crashes to nothing which is extremely unlikely. Therefore, you are likely to get back more than what you put in at the start. The only question is how much more.

This is where we talk about the upside of which there are two potential scenarios:

1️⃣ The first is if the Fed cuts interest rates and yields drop significantly. The price of the selected bond can potentially rise above the face value. You can then sell the bond in the secondary market to get back more than your invested capital before maturity. At the same time, the advanced volatility trading slice will be terminated and the proceeds will be received as additional profits. Of course, you can also choose to hold the bond to maturity to continue running the advanced volatility trading strategy.

2️⃣ The second is if interest rates remain high or continue to move higher. In this scenario, you will get back the full face value of the bond when the bond matures. The advanced volatility trading slice will then be terminated and the proceeds plus whatever accumulated profits will be the total return for the portfolio.

This is as good as it gets for an asymmetric trade and it is only available while the high interest rate environment lasts.

Find out ways you can invest through a casual coffee session!

AllQuant brings to the table a new solution for busy professionals. We put all our 30 years of joint experience across asset management, banking, proprietary trading, and hedge funds to work. And we designed various model portfolios for investors with different objectives and needs.

You can now build such portfolios through iFAST Global Markets without lifting a finger. In this collaboration, we are combining AllQuant’s expertise in hedge fund strategies and iFAST’s advisory capabilities and bringing it to your doorstep.

Ready to start your investment journey? Chat with us over a cup of coffee through a session facilitated by iFAST Senior Investment Adviser, Ou Da Wei, to find out more.

Comments