A Capital Protected Portfolio With High Upside - Is It Possible?

- AllQuant

- Apr 20, 2023

- 5 min read

Sounds too good to be true? Most people would be skeptical and that is a perfectly healthy response. In fact, we should always approach things with a dose of prudent cautiousness. But having said that, it is actually possible, except that such opportunities arise only under certain market environments and is subject to you accepting some constraints. While many people may be intrigued by this, capital-protected products are not new. Banks have been offering such products for years and their offerings come in many different forms. However, they can be complicated and their returns are often not that impressive. They do more than fixed deposits but lower than the long-term average stock market return.

A Look At Bank's Capital-Protected Offerings

You will find capital-protected offerings under the banks' structured products. They are also called structured deposits. But strictly speaking, they are not your typical deposits and hence not protected by Deposit Insurance. So in the event that the bank fails and becomes insolvent, you may not get your principal back. In a nutshell, whatever protection they give is only as good as their creditworthiness.

The payoffs of these structured deposits vary. Some pay a fixed amount of interest every year with added potential upside on maturity. Some are purely tied to the performance of a basket of securities, e.g. stocks. And there are also those with much more complicated payout structures. The tenors of such products also vary. They can be anywhere from as short as a month to as long as 10 years. And for the protection to hold, you have to lock your capital in for the entire tenor. You will know why shortly.

An example of what a structured deposit looks like :

3-year S&P 500 linked Deposit

Tenor : 3 years

Protection : Principal Protected (provided you hold it to maturity)

Payout : 50% of the S&P 500's gain from the specified initial date or zero if the S&P 500 loses money.

This is a deposit that locks you in for 3 years and then pays you your invested principal plus 50% of the gains S&P 500 made during the period (if any) when your deposit matures. So technically, on the surface, you got yourself a product that can deliver a potentially higher return than a normal fixed deposit with no risk of loss. Your worst case is when the deposit matures and the S&P 500 trades below the initial level set when your deposit starts. In this case, you end up not making any money over the 3 years.

Anyway, this is just a fictional example. Here is a real one offered by UOB.

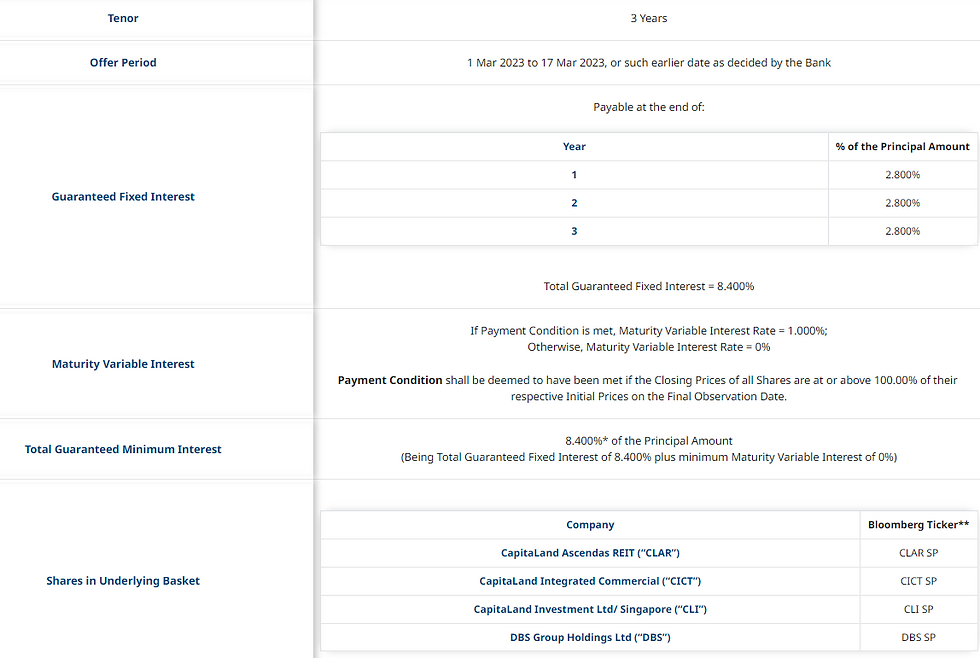

This deposit has a tenor of 3 years. At the end of each year, it pays 2.8% of the principal as interest. Then in the final year when the deposit matures, there is the potential of an additional 1% if the 4 Singapore stocks stated in their terms close above their initial price on the final observation date. So the maximum annual internal rate of return you are able to get from this product is around 3.1%.

How Do Banks Achieve The Capital Protection & Payoff

So how do banks pull this off? How are they able to safeguard your capital and still provide the upside?

Let's walk through with an illustration. Say we invested $100 in the 3-year S&P 500 linked deposit example I gave earlier. And for simplicity, let's also assume we can buy any products that I am going to talk about in any amount or denominations.

Capital Protection: They will use the majority of your invested capital to buy a Zero Coupon Bond (ZCB) that matures in 3 years. These bonds do not pay any coupons. They are just sold at a discount from their face value of $100 and on maturity, they pay you the full face value of $100. For example, a 3-year ZCB with an annual yield of 3.9% would be sold at a discounted price of $89.16. That means you pay $89.16 now and 3 years later when the bond matures, you get $100. So your capital protection is secured on condition that you are ready to hold the bond till it matures. (if you are new to bonds, you can an introductory video here).

S&P 500 Linked Payout: Since only $89.16 are used for the bond, we are left with $10.84. Let's assume the bank uses the entire $10.84 to purchase S&P 500 call options that expire in 3 years with a strike at or lower than the initial price. (if you need some introduction to options, you can watch a video here). But because options are expensive, it is unlikely they can purchase enough to give you 100% of S&P 500's returns when the deposit matures, at least not in our current market environment. So, that is why in my example, I arbitrarily use 50% of S&P 500's returns as a more realistic number. This percentage is often quoted as the participation rate in the terms of these products.

So that is the gist of how these products work behind the scenes.

We can create our own capital-protected portfolios with higher payouts

Now, as an individual investor, you can also construct and manage a portfolio that is the equivalent of simple "structured deposits" with an even higher potential payout without going through the banks. All you need is a ZCB with a solid credit rating such as the US Treasuries and a high return strategy.

The first part is straightforward, just get a broker that allows access to the bond markets. However, do note that to trade bonds, you do need a certain size else the dealers may not take the bite. The second part is the real challenge. With only a small portion of the money left after buying up the ZCB, you will need a high-performing strategy in order to generate a decent return on the total principal amount invested. Banks use options because it is leveraged, requires almost no management, and you won't lose more than the premium you paid. Unfortunately, they are expensive so the upside is significantly reduced. We will need a strategy that delivers strong returns, which while expected to be risky, will lose no more than what you have in the theoretical worst-case scenario.

And as you can probably tell, the best time to implement such "structured deposits" is when the interest rates are high like the current environment we are in now. Because that is where we can get our ZCBs at a lower price leaving us more resources to run our strategy and increase our upside potential.

DIY Capital-Protected Portfolio Vs Bank-Structured Deposits

While it may not be that apparent, there are actually many advantages to constructing your own capital-protected portfolio as opposed to getting one from a bank.

Besides the potential for higher returns (depending on your strategy), your invested capital is effectively backed by the US Government if you are using a US Treasury ZCB. In terms of credit quality, you can't get any better than an entity that is authorized to print the world's most traded currency.

Your risk is the insolvency of the broker you use to build the portfolio. But what you bought will be insured by your Brokers' Insurance. For US Brokers, that will be the Securities Investor Protection Corporation (SIPC) whose coverage goes up to $500,000. In contrast, with a bank's structured deposit, you might not see your money again if the bank files for bankruptcy.

And in terms of transparency, liquidity, and control, you are fully in charge. Should you need the money or if the ZCB appreciates above $100 due to lower interest rates before it matures, you can get your principal back earlier.

If you are interested to know more about how you can create such a portfolio for yourself with the assistance of an Investment Adviser from iFAST Global Market, feel free to drop us a note!

Comments