Retirement Journey Update for Jul 2022

- AllQuant

- Jul 31, 2022

- 3 min read

Markets were already undergoing a rebound from the sharp sell-off in June when Jerome Powell added fuel to the fire towards the end of July. While the 0.75bp rate hike was well-telegraphed in advance, the statement by Jerome Powell that future rate hikes might be in smaller increments was not. This led markets into a buying frenzy of things that were previously beaten down. As a result, most asset classes especially risky assets were up sharply in July.

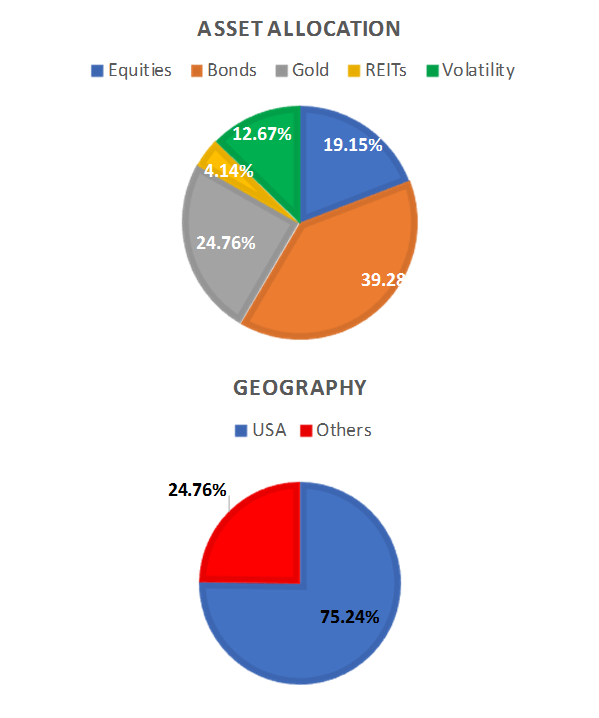

However, markets' perceived dovishness of Powell also provided the green light for commodity prices to recover from the earlier sell-off which was the reason for the cooling inflation expectations in the first place. If commodity prices were to go back up to previously high levels, inflation expectations might be driven up again. This tussle between the pace of rate hikes and inflation expectations may be the central theme for the rest of the year. Below is the breakdown by assets and geographies of the multi-strategy model maintained with iFAST as of the end of July.

Our portfolio benefitted from gains in most asset classes. Gold was the only drag on the portfolio. A short volatility positioning contributed the most as volatility came down sharply from the beginning of the month. Overall, the portfolio is up 2.8% in July, bringing the year-to-date loss to 13.9%.

Let's see how our retirement heroes are faring at the end of July 2022.

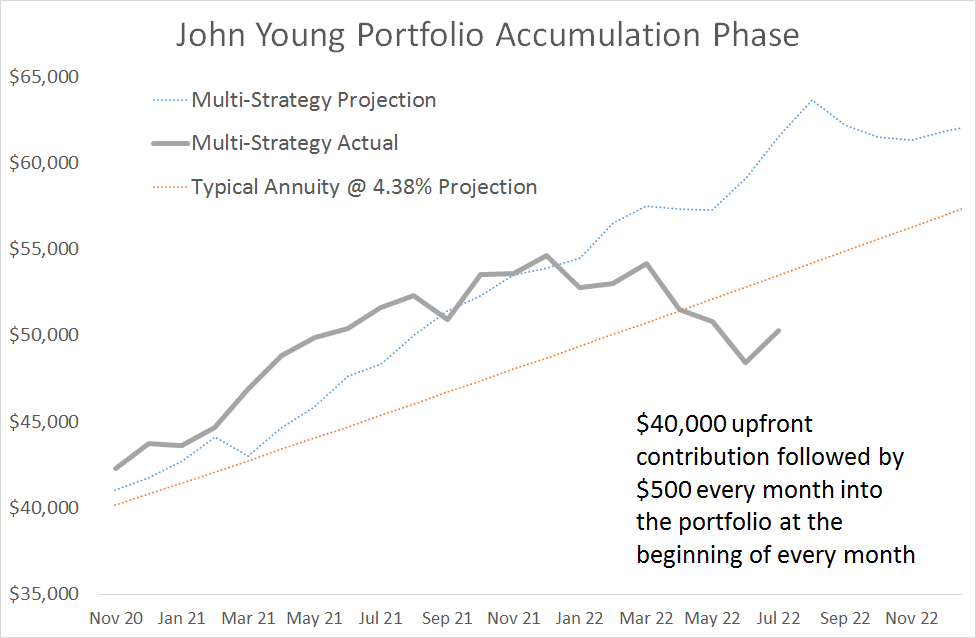

John, 31 years old, looking to retire in 19 years

John invested USD 40K upfront at the beginning of November 2020 and he regularly contributed USD 500 every month subsequently. As of the end of July 2022, he has contributed USD 50K. If he sticks to his plan, he can expect to withdraw USD 7.5K every month when he retires in 19 years without ever depleting his retirement nest egg.

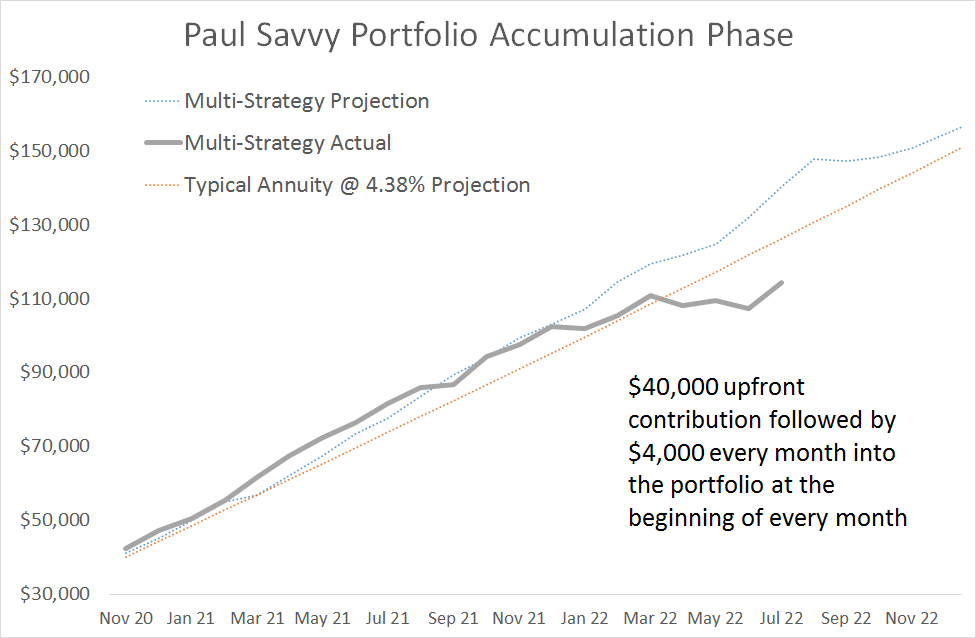

Paul, 51 years old, looking to retire in 9 years

Like John, Paul invested USD 40K upfront at the beginning of November 2020. However, he knows he has a shorter runway than John to compound his portfolio. The good thing is that he has a higher income than John so he contributes USD 4K every month subsequently. As of the end of July 2022, he has contributed USD 120K. If he sticks to his plan, he can expect to withdraw USD 9.5K every month when he retires in 9 years without ever depleting his retirement nest egg.

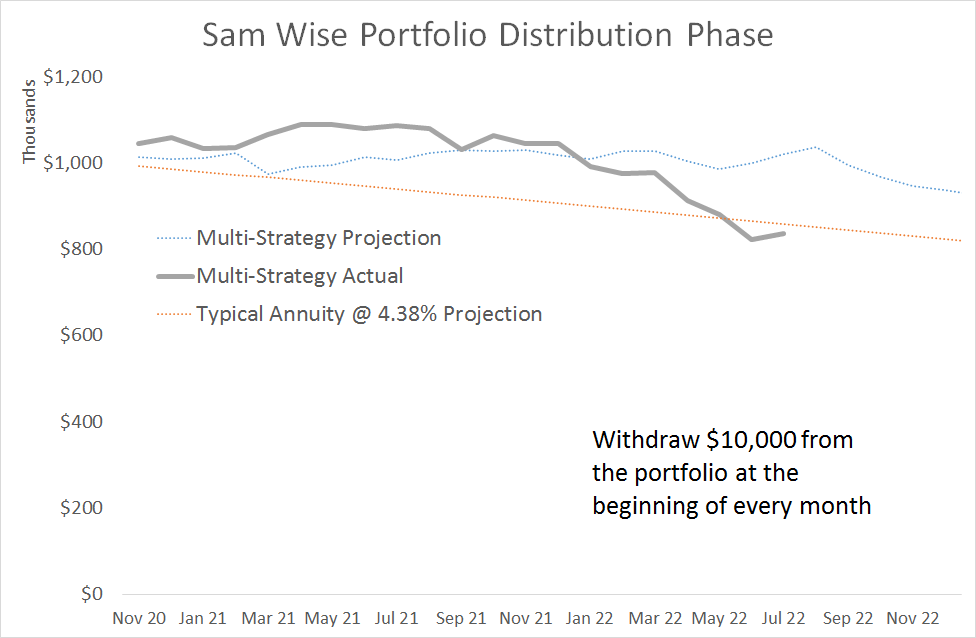

Sam, 66 years old, already retired

Sam doesn’t have any runway to compound his wealth as he is already retired. Fortunately for him, he had accumulated USD 1M of savings which he invested upfront at the beginning of November 2020 and started to draw out USD 10K every month from this portfolio. As of the end of July 2022, he has already drawn a total of USD 210K but his portfolio is still worth about USD 840K. He can expect to continue drawing USD 10K every month while his portfolio value remains about the same. This is a 12% withdrawal rate in a retirement account that never depletes.

Outsource Investment Management

AllQuant brings to the table a new solution for busy professionals. We put all our 30 years of joint experience across asset management, banking, proprietary trading, and hedge fund to work. And we designed an actively managed multi-strategy portfolio that is resilient enough to weather different market conditions.

You can now build such a portfolio through iFAST Global Markets without lifting a finger. In this collaboration, we are combining AllQuant’s expertise in hedge fund strategies and iFAST’s advisory capabilities and bringing it to your doorstep. Ready to grow your wealth stably and steadily?

Comments