3-in-1 Protection, Income & Growth In A Single Portfolio

- Eng Guan

- Jun 6, 2023

- 8 min read

Updated: Jun 7, 2023

When we invest, we are often asked what our primary objectives are. Are we investing for capital growth, are we looking for a stream of income, and how important is capital protection to us? This gives a sense of where our priorities are and how much risk we are able to stomach. This is a starting point where we can construct portfolios to meet the needs.

If a perfect solution exists, we will want it all – high growth, high income, and 100% protection. But we know it is not possible. Because there will definitely be tradeoffs. In a typical scenario, if you are looking for growth, you will be asked to park most of your funds in riskier assets such as equities. They can offer greater potential returns in the long run but you need to have holding power and be mentally prepared for volatile rides in rough times.

If you are looking for income, then chances are you will be recommended a basket of bonds and/or securities that pays regular dividends such as REITS. And if better yields are what you desire, then your portfolio might tilt towards the use of riskier high-yield bonds (aka junk bonds). However, there is no free lunch. While high-yield bonds usually do not pose problems in good times, they do have a considerably higher probability of default when a market downturn hits. Alternatively, if you want more assurance of safety, then you might be presented with a portfolio comprising good quality sovereign, agency bonds, and investment-grade corporate bonds. The downside risk will be significantly reduced, but the tradeoff is the yields will not be as appealing.

The level and quality of protection you want will determine the mix and type of assets used to construct the portfolio. But more often than not, it is very challenging to achieve something that measures up meaningfully in all three aspects of growth, income, and protection at the same time.

A portfolio that achieves a decent level of protection, income, and growth

A flawless solution that gives you the whole cake is impossible. But one that tries to meet as much of each may not be off limits in the current market environment. In fact, the same structure I previously wrote on capital-protected portfolios can be tweaked to achieve that. If you miss out on that post or want to refresh your memory, you might want to read it here so that you can better understand what follows.

Let’s look at how we can address these 3 things:

1. Capital Protection – The high-interest rate environment today opens up an opportunity for us to use bonds to secure a good level of protection. The question is how much protection we are looking at and how long are we willing to lock up our capital. The higher the protection and the shorter the investment horizon mean more of our capital will be locked up in bonds. That leaves us less capital to run other strategies that can generate growth and income. So, an option here is to commit to a reasonable investment horizon and go for a lower level of protection that we are still comfortable with.

2. Income – Most people are used to investing in securities that has a built-in payout. For example, with most coupon-paying bonds, we can get a fixed amount every 6 months. Or if we built a portfolio out of REITs or blue chips, we can get regular dividends, but the amount varies. Now, there are other ways to get income even if our portfolio does not have any coupon-bearing or dividend-paying securities. And that is to draw down on our portfolio, preferably from its accumulated profits. This concept is not any different from a company paying us a dividend out of its profits. Any dividends paid are also directly deducted from its share price on the ex-div date. However, to draw down on our portfolio, we need a good strategy that can grow our money at a rate fast enough to finance these drawdowns. As with all strategies, there will be risks, so the regularities of these payouts are not guaranteed. But it can be managed to make it more sustainable. One way is to take profits along the way and build a cash reserve to finance these payouts.

3. Growth – The amount of growth we can achieve will also depend on the investment strategy used. So, this strategy is of paramount importance as it serves a dual purpose - both income and growth. Basically, I regard growth as any excess accumulated profits we have over and on top of what is needed to finance our regular payouts. In practice, we can reinvest these profits elsewhere to earn additional yields.

Portfolio Model Setup and Study

To test how well this can work, I modeled a setup with the following requirements.

Capital: $200,000

Investment Horizon: 5 years

Capital Protection: 85%

Target Monthly Payout: $1,600 (payout is not guaranteed)

If we can get $1,600 every month without fail out of a $200,000 investment, that will be approximately the equivalent of a par bond paying a 9.6% coupon rate. This is higher than what high-yield bonds are paying and yet the portfolio has a lower level of risk because of the underlying assets used to build it as we will see shortly.

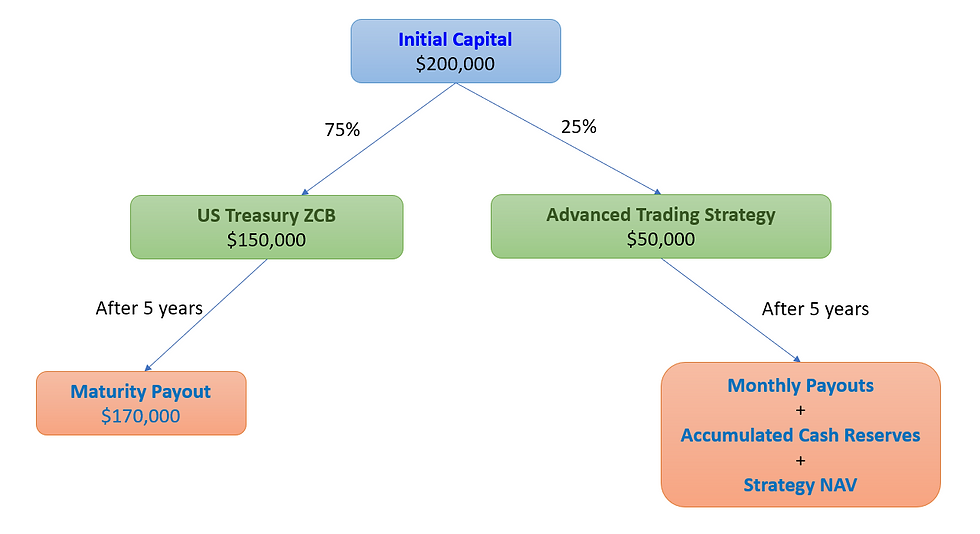

For capital protection, we can buy a US Treasury Zero Coupon Bond (ZCB) that matures in 5 years. As of the point of writing, the current yield is about 3.9% and they are priced around $87. That means if we buy the bond at $87, it will pay us $100 when it matures. Since we are only targeting capital protection of 85%, we only need to put up 74% of our capital. But to make things easy, let’s just take it that 75% of our capital, or $150,000 is used to purchase the ZCB. With protection backed by the full faith of the US Government, default risk is virtually non-existent.

Note: That is the gist of it. But in practice, even though brokers allow you to key in orders for bonds in denominations of $1000, the size required to transact in the secondary market can be much larger as bond dealers may not take the bite on small sizes. But let’s assume that we have no such issues.

As for the remaining 25% or $50,000, we will allocate it to an advanced trading strategy that is capable of generating higher returns*. But of course, it also comes with higher risks. To build up the cash reserves that will finance the monthly payouts, we will take profits every time this strategy makes 10% or $5,000. These profits will accumulate as cash reserves in our account. Then at the end of every month, we will check against the cash reserves. If there is sufficient cash, we will pay out $1,600 to ourselves.

* We are using an advanced volatility trading strategy that we run with iFAST GM senior investment advisor, Ou Da Wei.

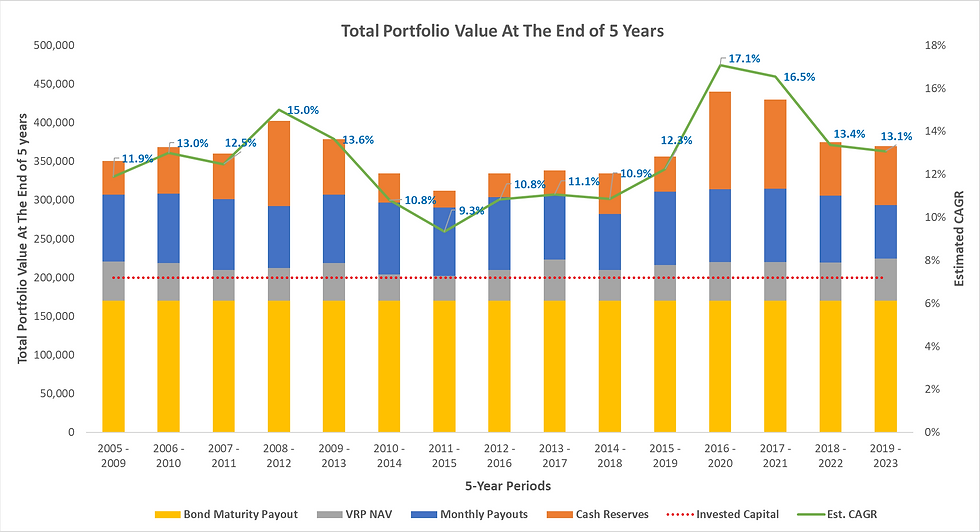

To see if this is viable, I run historical backtests on this model setup over rolling 5-year periods. As an example of what I mean, I first tested the model from 2005-2009 (inclusive of both years), then I move on to see how it performs for 2006-2010, and then 2007-2011, and so on and so forth. Then at the end of each 5-year period, I compute the total value we would have gotten at the end. The total value is basically the sum of the following:

Total monthly payouts received

Cash reserves from accumulated profits

NAV of the advanced trading strategy

US Treasury ZCB payout at maturity of $170,000

The diagram below summarizes what the setup looks like.

The Model Study Results

We do not have to concern ourselves with the ZCB payout at the end of the 5-year period. Since we are using a US Treasury ZCB, we can safely assume that we will get the full face value of the bonds we bought which will be $170,000. So the only variables that can impact the outcome are the total monthly payouts we received, the cash reserves we have, and the NAV of the advanced trading strategy at the end of the period.

1. The model has an average monthly payout probability of 93%

The outcomes are fairly impressive. The monthly payout probability ranges between 76% to 100% with an average of 93%. So out of most 59 possible monthly payouts over each 5-year period, we can expect to get 55 of them. In the best scenario, we get paid every month. And at worst, we still get 45 monthly payouts.

2. The key determinant of the difference between the total gains made over all the 5-year periods is the cash reserves built from accumulated profits.

The number of payouts is a major but not the main determinant of the total gains we make at the end of 5 years. The total monthly payouts are not too far off in most scenarios. What makes the key difference to the overall gain of these model portfolios is the cash reserves from the accumulated profits across all the 5-year periods. It ranges from as low as about $22,000 to $126,000.

2. The estimated CAGR ranges between 9% to 17% with an average of 12.7%.

In all the scenarios, we will receive total payouts between $312,000 and $440,000 if we take into account all the monthly payouts we make, our cash reserves at the end, the liquidation value of our advanced trading strategy, and the maturity payout of our US Treasury ZCB. If we assume that all cashflows were received at the end of the 5 years and do a simple calculation, that translates into a range of 9% to 17% with an average of 12.7% p.a. in terms of CAGR. This would be higher than what any bonds can give you.

The risks and tradeoffs

So it is possible to structure a portfolio that is almost fully protected and fairly reliable in terms of monthly payouts and still retain some growth potential. But as you can see, how this portfolio performs hinges almost entirely on how the advanced trading strategy fares. While it has the potential to deliver higher returns, it is also a volatile strategy where you can experience big swings. In particular, there can be extended down periods before meaningful cash reserves can be accumulated. This is also why the model fails to pay out in some months.

The range of returns we see is projected based on historical data. Both worse or better scenarios in the future cannot be ruled out. We don’t know the limit of where the best case can be. But we do know the theoretical worst case and that occurs when the advanced trading strategy fell apart and crashes to zero. This is, however, extreme even among tail events with only a very remote possibility. But should it happen early in the investment before any payout occurs, then you will only get back 85% of your invested capital.

Find out ways you can invest through a coffee session!

AllQuant brings to the table a new solution for busy professionals. We put all our 30 years of joint experience across asset management, banking, proprietary trading, and hedge fund to work. And we designed an actively managed multi-strategy model portfolio that is resilient enough to weather different market conditions.

You can now build such a portfolio through iFAST Global Markets without lifting a finger. In this collaboration, we are combining AllQuant’s expertise in hedge fund strategies and iFAST’s advisory capabilities and bringing it to your doorstep.

Ready to start your investment journey? Chat with us over a cup of coffee through a session facilitated by iFAST Senior Investment Adviser, Ou Da Wei, to find out more.

Disclaimer & Disclosure

We are not financial advisers or fund managers. The information published on this Site is provided for informational purposes only. It is not intended to be, nor shall it be construed as, financial advice, an offer, or a solicitation of an offer, to buy or sell an interest in any investment product. Nothing on this site constitutes accounting, regulatory, tax, or other advice.

Any performance shown on this Site is model performance and is not necessarily indicative nor a guarantee of future performance. You should make your own assessment of the relevance, accuracy, and adequacy of the information contained on this Site and consult your independent advisers where necessary.

AllQuant is carrying out introducing activities for iFAST Global Markets (Singapore) as an independent entity and is NOT an agent, servant, employee, representative, or in partnership with iFAST Global Markets (Singapore). AllQuant will be receiving remuneration or introducing fees from iFAST Global Markets (Singapore).

Comments