Foundational Multi-Strategy Performance Update & Reminder on March Promotion

- AllQuant

- Mar 28, 2024

- 2 min read

We have been providing regular updates on the Advanced Multi-Strategy performance which can be implemented with iFAST. So here's a rare update on our foundational multi-strategy model performance which we teach in our courses. We are proud to say that it has also done well.

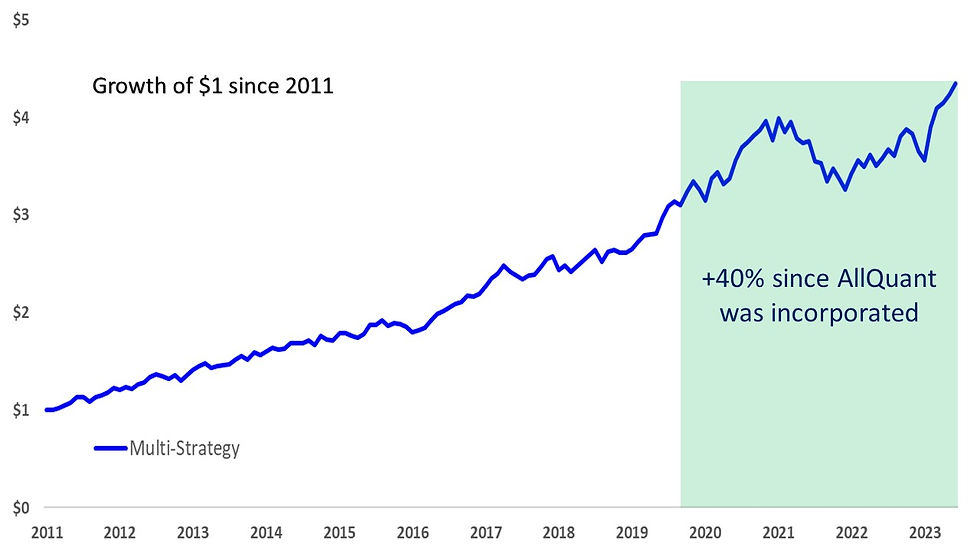

AllQuant was founded in June 2020 and we are three months shy of our 4th anniversary. In this period, we have gone through the COVID-19 pandemic, and the aggressive interest rate hiking cycle caused by surging inflation. The foundational multi-strategy model portfolio weathered through and generated a total return of 40%.

A 40% return during this period may not seem exceptional compared to the S&P 500 or the Nasdaq. However, remember that the multi-strategy portfolio holds multiple assets like US treasuries. It should be compared to a multi-asset benchmark rather than a stock index. A standard 60/40 portfolio, using ACWI for the stock allocation and BNDW for the bond allocation, is up 30% over the same period.

What is the Multi-Strategy Portfolio?

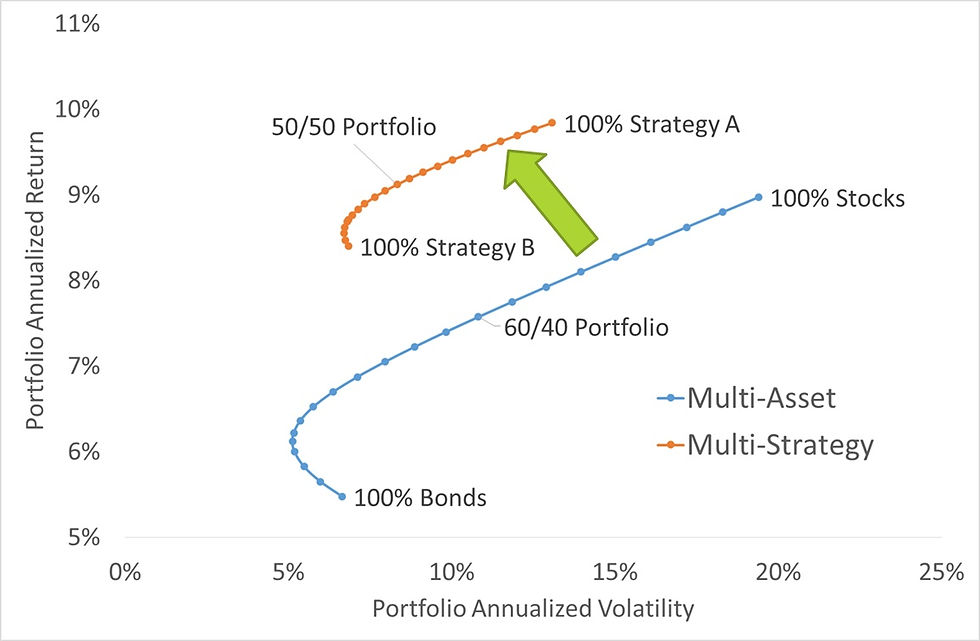

For those who have attended our courses before, you should know about the multi-strategy approach. For readers new to AllQuant, the multi-strategy approach represents the best chance of achieving the highest portfolio return for the least risk. It is an innovative improvement to the Modern Portfolio Theory (MPT) and the bedrock of AllQuant's approach to investing. Below is a 9-minute video explaining MPT.

If there is one chart to show how the multi-strategy approach improves on MPT, it will be the one below. To cut it short, the multi-strategy approach allows a portfolio to generate higher returns with less risk than what a traditional multi-asset portfolio can achieve.

Gain a better understanding through our online courses

AllQuant has specially curated courses to teach the everyday investor how to use strategies employed by institutions to run their portfolios.

Learn how to build a resilient portfolio and get the most bang for your buck. Say goodbye to sleepless nights. Make use of the ongoing March promotion to enroll in our online courses. This promotion ends soon.

Disclaimer & Disclosure

We are not financial advisers or fund managers. The information published on this Site is provided for informational purposes only. It is not intended to be, nor shall it be construed as, financial advice, an offer, or a solicitation of an offer, to buy or sell an interest in any investment product. Nothing on this site constitutes accounting, regulatory, tax, or other advice.

Any performance shown on this Site is model performance and is not necessarily indicative nor a guarantee of future performance. You should make your own assessment of the relevance, accuracy, and adequacy of the information contained on this Site and consult your independent advisers where necessary.

AllQuant is carrying out introducing activities for iFAST Global Markets (Singapore) as an independent entity and is NOT an agent, servant, employee, representative, or in partnership with iFAST Global Markets (Singapore). AllQuant will be receiving remuneration or introducing fees from iFAST Global Markets (Singapore).

Comments